Managing international and local transactions has never been easier for Kenyans and other countries that use Mpesa, thanks to the integration of PayPal and Mpesa. Whether you are a freelancer receiving payments in USD or a business owner looking to expand globally, this partnership allows you to withdraw money from PayPal to Mpesa quickly and securely. Additionally, you can top up your PayPal account using funds from your Mpesa account, making this service a game-changer for financial management in Kenya.

This guide explains the step-by-step process to withdraw funds from PayPal to Mpesa, add money to PayPal from Mpesa, and maximize the benefits of this partnership. Read on to learn how to streamline your money transfers and stay ahead in today’s digital economy.

What is PayPal and How Does It Work?

PayPal is a widely recognized payment service used globally for sending, receiving, and managing payments securely. It’s especially popular among freelancers, online businesses, and those making international transactions. PayPal allows you to withdraw funds into your local accounts and even convert balances into different currencies, like USD.

Linking PayPal to Mpesa: Step-by-Step Guide

To transfer funds between PayPal and Mpesa, you must have a verified PayPal account linked to your Mpesa number. Here’s how to link the two accounts:

- Start by visiting the official PayPal to Mpesa website powered by Thunes in collaboration with Safaricom.

- Click the “Get Started” button, which will prompt a popup for logging into your PayPal account. Enter Your PayPal details to log in.

- After logging in, review and accept the terms and conditions, then select “Agree and Connect” to proceed.

- Enter your Mpesa registered mobile number and click “Link your accounts.” A four-digit verification code will be sent to the mpesa number you entered as a security measure.

- Enter this code to finalize the process.

- Once completed, your Mpesa account will now be successfully linked to your PayPal account, allowing you to transfer money seamlessly between the two.

How To Withdraw Money From Your PayPal Account

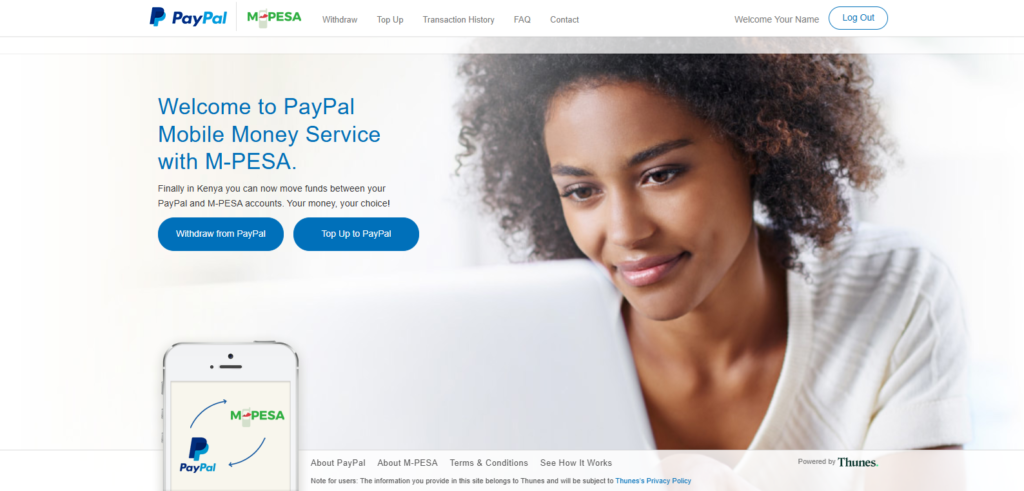

Now after linking your PayPal account to Mpesa, you can now withdraw funds to your Mpesa account. Below is a step by step guide.

- Log in to your account through the PayPal to Mpesa service website and click “Withdraw from PayPal”

- Enter the amount you want to withdraw in USD.

- Confirm the amount you want to withdraw, if its correct click withdraw.

- A confirmation message will be send to your mpesa number, adding the money you withdrew to your mpesa account.

NOTE: The maximum amount to withdraw from PayPal to Mpesa is KES 150000 per transaction.

How To Top Up Your PayPal Account Using Mpesa

The PayPal to Mpesa service also enables you to add funds to your PayPal account using your Mpesa account. Here is a step by step guide on how to do it:

- Log in to your account via the PayPal to MPesa service website and click “Top Up to PayPal.

- Enter the amount you wish to add to your paypal account in USD to calculate the amount you need in your Mpesa account to complete the transaction and click Calculate.

- The Amount you need in your Mpesa will be displayed In KES.

- Now on your phone, navigate to the MPESA menu and select “Lipa na M-PESA.

- Then choose the “Pay Bill” option.

- Enter 800088 as the Business Number and your phone number (the one linked to your Paypal Account) as the Account Number.

- Input the amount displayed on the PayPal to Mpesa website.

- Enter your M-PESA PIN, and confirm the transaction.

The top-up amount will be credited to your PayPal account instantly, allowing you to use the funds from the PayPal Account immediately.

You can as well use our calculator below to know the amount of money you need in your mpesa account before topping up your PayPal account.

MPESA to PayPal Calculator

Key Benefits of PayPal Mpesa Integration

- Accessibility: No need for a bank account to access international funds.

- Speed: Quick processing times, usually within 2 hours to a few days.

- Convenience: Directly access funds in Kenyan Shillings.

- Global Reach: Accept payments from international clients or platforms.

- User-Friendly Interface: Easy to link and use both services together.

Conclusion

The mpesa PayPal partnership offers an innovative solution for managing funds in Kenya. Whether you’re a freelancer receiving payments, an online shopper, or a business owner, this integration simplifies your financial transactions.

Bullet Point Summary

- Linking Accounts: Use the PayPal Mobile Money Service to link your PayPal and M-Pesa accounts.

- Topping Up PayPal: Transfer funds from Mpesa to PayPal easily.

- Withdrawing Funds: Withdraw funds in Kenyan Shillings directly to your MPesa account.

- Exchange Rates and Fees: Always review the rates and charges before confirming transactions.

By understanding these processes, you’ll be empowered to take full advantage of the PayPal mpesa services, ensuring seamless and efficient financial management.

More Articles For You:

- Online jobs In Kenya That Pay Through Mpesa

- Best Mode Earn App Review: Is Mode Mobile Legit?

- Top 20 Secret Websites to Make Money Online

- Is Cash Giraffe legit or Scam? Honest Cash Giraffe Review

- Best Mode Earn App Review Is Mode Mobile Legit?

Frequently Asked Questions On PayPal Mpesa Intergration

How do I start a transfer from PayPal to Mpesa?

First, log into your PayPal account. Then, visit the PayPal Mpesa service portal and choose “Withdraw from PayPal.” Follow the prompts to complete the transaction.

Are there fees when withdrawing money from PayPal to Mpesa?

Yes, there are fees involved. PayPal charges for currency conversion and international transfers, while Mpesa may also have its transaction fees.

How long does it take for money to arrive in my Mpesa account?

Usually, it takes a few minutes for the funds to reflect in your M-Pesa account after completing the withdrawal from PayPal.

Can I cancel a PayPal to Mpesa transfer after it’s started?

No, once you confirm the transfer, it cannot be canceled or reversed. Make sure to review all details before proceeding.

What should I do if my transaction fails?

If a transaction fails, check your account balance and details. If the problem persists, contact PayPal or Mpesa customer support for help.

Is it safe to transfer money from PayPal to Mpesa?

Yes, both PayPal and Mpesa have security measures to protect your transactions. Use strong passwords and enable two-factor authentication for added security.