Budgeting apps are changing the way we manage our money, and in 2026, they’re smarter, faster, and more intuitive than ever. Whether you’re trying to get a handle on your spending, save more, or just keep your personal finances organized, the right budgeting app can make a world of difference. The goal is no longer just about tracking expenses—it’s about making budgeting simple, visual, and even a little enjoyable.

Budgeting apps are simply tools that make it easier to create a budget, monitor spending habits, and reach their financial goals. This guide delivers exactly that. We’ve rounded up the top budgeting apps in 2026, broken down what makes them great, and included real-world tips to help you choose the best budgeting app for your needs. So, if you’re wondering whether budgeting apps work, or which ones are worth your time and money—you’re in the right place.

As someone who’s personally tested dozens of finance tools over the years—some frustrating, some fantastic—I know the difference the right budgeting app can make. Whether you’re using a free app, trying a free trial, or looking for a full-featured finance app to help you stay on track, this article will help you navigate through the noise and find the best options available today.

Key Takeaways

- Budgeting apps are designed to help users manage their money, track expenses, and plan savings.

- The best budget apps in 2026 are user-friendly, offer automation, and include integrations with bank accounts and credit cards.

- There are free and paid options—many apps offer a free trial or a free version with core features.

- Features vary from zero-based budgeting to envelope budgeting methods, so choosing the budgeting method that fits your style is crucial.

- This guide will cover the 5 best budgeting apps in 2026, what to look for in budgeting tools, and alternatives to budgeting apps.

- Whether you’re new to budgeting or just want a better tool, we’ll help you choose a budgeting app that’s right for you.

Why You Need a Budgeting App in 2026

Let’s be honest—managing money in today’s world is harder than ever. Subscriptions, digital wallets, online shopping—it’s easy to lose track of where your cash is going. That’s where a good budget app steps in. A budgeting app can help you see the full picture of your personal and business finances, giving you control and clarity with minimal effort.

Back in the day, I used spreadsheets and notebooks to track my income and spending. It worked—for a while. But I found myself making mistakes or forgetting to update my entries. Since switching to a budgeting app, I’ve saved hours each month and significantly increased my savings. These apps make it easy to connect to your bank accounts, categorize expenses automatically, and even send alerts when you’re close to overspending. And many budgeting apps offer built-in goals to help you save for that big vacation or emergency fund.

Most importantly, every budgeting app on our list is designed to fit different styles of money management. Some are great for families; others are built for freelancers or side hustlers. Whether you’re into detailed tracking or just want a basic overview, there’s something for everyone.

Understanding Budgeting: It’s More Than Just Numbers

Before we dive into the apps that offer top-tier features, it’s helpful to understand what budgeting is really about. A budgeting tool is not just a calculator—it’s a financial plan you build for yourself. A good budget app will do more than just record transactions; it’ll guide your decisions, highlight trends, and push you toward your goals. In 2026, many budgeting apps make it easy to customize these plans based on your lifestyle, which makes the experience more personal and less robotic.

Using a budgeting app is like having a financial coach in your pocket. Some follow the zero-based budgeting method, where every dollar you earn is assigned a purpose—savings, bills, or fun. Others use the envelope budgeting method, where you digitally divide your income into spending categories. Either way, these tools empower you to manage your personal finances more efficiently.

5 Best Budgeting Apps in 2026

Choosing the best budget apps in 2026 wasn’t easy. With so many budgeting apps on the market, we tested dozens to bring you the top contenders that offer the best possible experience. These five stood out in terms of usability, features, support for multiple bank accounts, and value. Whether you want a free budgeting app or don’t mind paying for advanced features, here are the top budgeting apps worth considering this year.

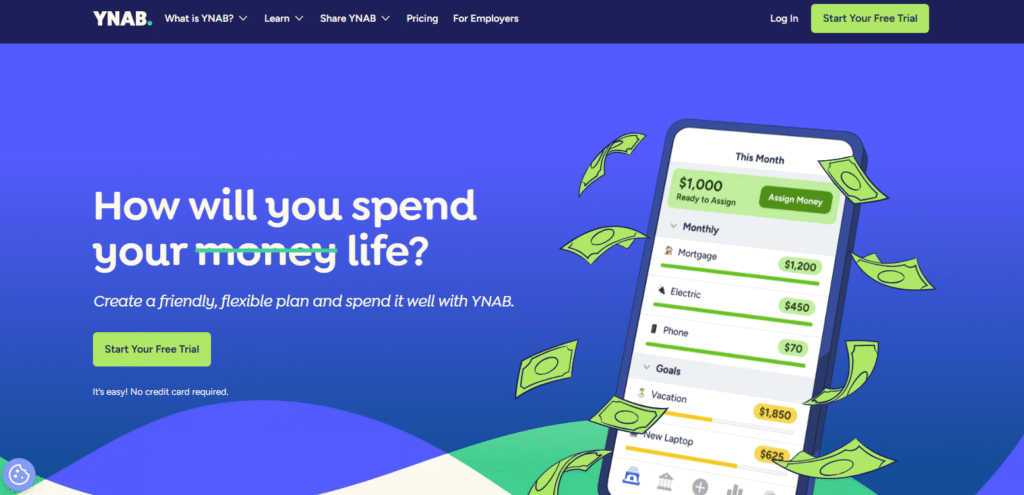

1. YNAB (You Need a Budget)

If you’ve done any research on budgeting apps, you’ve probably heard of YNAB. It’s built around the zero-based budgeting philosophy, where every dollar gets assigned a job.

Pros:

- Excellent for those who want a hands-on budgeting experience

- Strong focus on goal setting and real-time tracking

- Connects to your bank accounts and credit cards for seamless syncing

Cons:

- No free version, though it offers a 34-day free trial

- Learning curve for beginners

Why it’s great: YNAB’s proactive budgeting method helps users make conscious choices with their money. It’s ideal if you’re committed to detailed money management using the zero-based budgeting approach.

2. Mint (Now Intuit Credit Karma)

Mint has long been a household name, and now that it’s integrated with Intuit Credit Karma, it offers more than just budgeting features.

Pros:

- Completely free app

- Offers credit score tracking and bill alerts

- Automatically categorizes and tracks spending

Cons:

- Occasionally buggy with bank account syncing

- Ads can be intrusive

Why it’s great: It’s one of the best free budgeting app options for users who want a simple, set-it-and-forget-it experience. Mint is best for basic budgeting and overall personal finance snapshots.

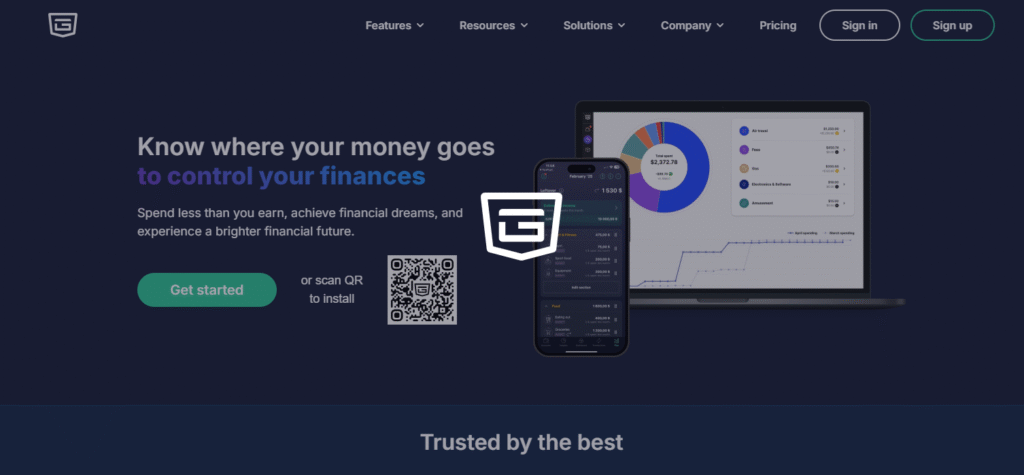

3. PocketGuard

PocketGuard is all about simplicity. It shows you how much money you have left to spend after accounting for bills, goals, and necessities.

Pros:

- Visual, user-friendly interface

- Identifies recurring charges and suggests where to cut back

- Offers a free version with optional upgrades

Cons:

- Limited customization in the free version

- Not ideal for complex budgeting needs

Why it’s great: If you want a budgeting app to help you avoid overspending without much effort, PocketGuard is a great pick. It’s a finance app that makes managing money less stressful.

4. Goodbudget

Goodbudget is based on the digital envelope budgeting method, which can help users manage spending by dividing funds into digital envelopes.

Pros:

- Great for couples or families sharing a budgeting platform

- Syncs across devices

- Offers a robust free version

Cons:

- No bank syncing—you manually input transactions

- Not ideal if you want automation

Why it’s great: Perfect for people who like a more hands-on approach and want to stick to the traditional envelope budgeting style without the paper envelopes.

5. EveryDollar

Developed by Dave Ramsey’s team, EveryDollar follows a strict zero-based budgeting system and aims to simplify money planning for everyone.

Pros:

- Clean, intuitive layout

- Great for beginners

- Encourages users to review your budget regularly

Cons:

- Full features require a paid plan

- Some bank syncing issues reported

Why it’s great: If you’re following the Ramsey approach or just like the idea of assigning every dollar a purpose, this app is designed to help you stay accountable and build better habits.

How to Choose the Right Budgeting App for You

Not every budget app is created equal, and what works for one person might not be ideal for another. That’s why choosing the right budgeting app really comes down to your lifestyle, financial goals, and personal preferences. Whether you’re managing multiple bank accounts, tracking a side hustle, or just starting your budgeting journey, there are key features to consider when trying to find the best match.

What to Look for in Budgeting Apps

If you’ve ever downloaded an app only to delete it days later, you’re not alone. Many apps promise more than they deliver. To make budgeting work, the app is designed to help, not frustrate. Here’s what to look for in budgeting apps:

- Ease of Use: Apps should be intuitive. If it takes you an hour to set up, it may not be the right fit.

- Bank Integration: The best budgeting apps connect seamlessly to your bank accounts and credit cards, updating automatically.

- Budgeting Method Support: Some apps focus on zero-based budgeting, others on the envelope budgeting style. Choose based on what resonates with you.

- Free Trial or Free Version: Trying out the app through a free trial or free version helps you get a feel for the tool before you pay for a budgeting app.

- Goal Tracking & Alerts: Good budgeting features include spending alerts, savings goals, and debt payoff tracking.

Apps that offer these basics tend to deliver a better experience. Personally, I always look for an app that updates in real-time, categorizes expenses automatically, and doesn’t bombard me with ads.

Choosing the Best Budgeting App Based on Your Lifestyle

Now that we know what to expect, let’s match apps to lifestyles. Different people have different budgeting needs, and the apps on our list cater to a variety of users:

- Busy Professionals: Need automation? Go for apps that sync with financial accounts and categorize spending.

- Couples and Families: Look into apps that sync across devices and allow for shared budgeting tools like Goodbudget.

- Beginner Budgeters: Simplicity is key. EveryDollar or Mint offers basic budgeting features with friendly interfaces.

- Advanced Users: If you like charts, detailed reports, and granular control, YNAB is a top contender.

Apps also differ in how they handle savings accounts, investments, or debt repayment plans. If your focus is growing a savings account or paying off student loans, choose a tool that highlights progress toward those specific goals. You should also think about how much effort you want to put in. Some apps allow you to create a budget in minutes, while others require more involvement.

Alternatives to Budgeting Apps

Maybe you’ve tried a few apps and they didn’t stick. That’s okay. There are alternatives to budgeting apps that can still help you manage money effectively.

- Spreadsheets: Google Sheets or Excel templates allow full customization. They’re great if you prefer control over automation.

- Manual Methods: Old-school but effective—journals or budgeting notebooks still work for visual planners.

- Bank Tools: Many banks now offer integrated basic budgeting tools in their mobile apps, which can be surprisingly effective.

The downside? These options might lack the advanced alerts or syncing abilities that budgeting apps provide, but they’re still valid for people who want simplicity and control without another mobile app.

Making the Most of Your Budgeting App in 2026

Now that you’ve explored the top budgeting apps and hopefully found the right budgeting app for your needs, the next step is maximizing its potential. Just downloading an app to help track spending isn’t enough—you’ve got to actively engage with it. Here’s how to get the most out of using a budgeting app in 2026.

Set Realistic Goals and Review Your Budget Regularly

Setting a budget is not a one-time thing. Your expenses, income, and goals evolve—and so should your budgeting tool. Whether you’re planning for a vacation, saving for a car, or just trying to stretch your paycheck, take time each week to review your budget. Many budgeting apps offer notifications and reminders to help you stay on top of your goals.

Apps like YNAB and EveryDollar are perfect for goal setting because they use the zero-based budgeting method, which requires you to assign every dollar a purpose. This keeps you aware of where your money is going and how it’s working for you. Regularly updating and checking your progress makes a big difference.

Connect All Accounts in One Place

One of the best features of budgeting apps is their ability to connect to your bank and bring your financial life into one dashboard. Most apps allow you to link your bank accounts, credit cards, and even your savings account for seamless tracking. When all your data is consolidated, your budgeting experience becomes far more effective.

If you’re worried about security, don’t be—popular budgeting apps use bank-level encryption to protect your data. Just make sure to update your credentials and check account syncs regularly.

Embrace the Features That Match Your Style

Every budgeting app on our list has something unique. Some are ideal for those just starting out, while others are tailored for seasoned personal finance nerds. Once you’ve committed to an app, dive deeper into its settings.

Set up category alerts, automatic bill tracking, and recurring income. Use features like debt payoff planners, savings account trackers, and monthly reports. These tools turn a good app into a great budgeting platform that empowers you to manage your personal finances effectively.

Remember, budgeting apps make it easy to build habits—but you’ve got to stick with them. Even if you start with a free budgeting plan, most apps offer upgrades later with advanced tools. If you feel the app can provide more value, consider the paid version—it might be worth it.

Final Thoughts: Budgeting Apps

The truth is, budgeting apps don’t work unless you do. But with the variety of apps like YNAB, Mint, PocketGuard, and Goodbudget available today, budgeting no longer feels like a chore. In 2026, apps make it easy to stay organized, track progress, and feel in control of your money.

Whether you’re just learning how to create a budget, or you’re an expert trying to optimize cash flow, there’s never been a better time to explore budgeting apps. From basic tracking to advanced zero-based budgeting, you now have the knowledge to choose the best budgeting strategy for your goals.

So, take that next step. Open your favorite finance app, connect your accounts to a budgeting app, and start building your financial future—one smart decision at a time.

Your journey to better budgeting starts now.

Explore More Articles

Frequently Asked Questions

1. What is a budgeting app and how does it work?

A budgeting app is a digital tool that helps you track income, expenses, and savings in one place. Most budgeting apps connect to your bank accounts and credit cards, automatically categorizing transactions to give you a clear view of your spending.

2. Are budgeting apps safe to use?

Yes, reputable budgeting apps use high-level encryption, similar to banks, to secure your data. Always choose apps with strong reviews, transparent policies, and security features like two-factor authentication.

3. What should I look for in budgeting apps?

Look for features like account syncing, customizable budgets, real-time alerts, and user-friendly design. If you’re following a zero-based budgeting approach, choose an app that supports that method.

4. Are there free versions of budgeting apps?

Yes, many popular budgeting apps offer a free version with essential features. Examples include Mint and Goodbudget. You can later upgrade if you need more advanced tools.

5. Can budgeting apps help me save money?

Absolutely. A budgeting app can help you spot spending habits, set savings goals, and stick to a plan. Over time, this can lead to better financial decisions and increased savings.

6. What’s the difference between envelope budgeting and zero-based budgeting?

Envelope budgeting allocates money into digital “envelopes” for specific categories, while zero-based budgeting ensures every dollar of income is assigned a job. Both methods are supported by various budgeting apps like Goodbudget and YNAB.

7. Do I need to pay for a budgeting app to get the best features?

Not necessarily. Some free apps offer robust features, but others limit functionality until you subscribe. If you’re serious about managing personal and business finances, paying for an app might offer more value.

8. How often should I update my budget in the app?

Ideally, check in weekly. This lets you adjust for unexpected expenses, review progress, and stay aligned with your goals. Some apps also provide daily summaries and alerts to keep you informed.