Your credit score is not just a random number, it’s your financial reputation. Think of it as your report card for how well you manage money. Lenders, landlords, insurance companies, and sometimes even employers use it to decide whether they can trust you financially. A good score opens doors to lower interest rates, better loan approvals, and even job opportunities. On the other hand, a poor score can feel like carrying around a financial weight that limits your choices.

Many people believe improving their credit score takes years, but that’s not always true. With the right strategies and a bit of discipline, you can see improvements in as little as 30 to 60 days. Of course, some changes take longer to fully reflect, but making consistent positive moves can give you a faster boost than you might expect.

It’s also important to clear up a few myths. For example, some people think checking their own score lowers it, but it doesn’t. That’s called a “soft inquiry,” and it has no effect. Others assume paying off old debts automatically deletes them from reports that’s also not true. Understanding how credit scores really work is the first step to improving them quickly and strategically.

In this guide, we’ll break down 10 proven strategies on how to improve your credit score quickly. Whether you’re preparing for a mortgage, looking to refinance, or just want financial peace of mind, these steps can make a real difference.

Key Takeaways

- Paying bills on time is the #1 credit booster. Since payment history makes up 35% of your score, even one late payment can cause a big drop.

- Lowering credit utilization drives fast results. Keeping balances below 30% (ideally 10%) of your credit limit often leads to noticeable improvements within weeks.

- Disputing credit report errors can deliver quick wins The FTC reports that 20% of consumers have mistakes on their credit reports. Fixing these can raise your score almost instantly.

- Becoming an authorized user accelerates growth Piggybacking on a family member’s well-managed account can add years of positive history to your credit.

- Good habits outweigh quick fixes While tools like Experian Boost may give short-term gains, the most reliable improvements come from consistent, responsible credit management.

Why Is a Good Credit Score Important?

A good credit score is more than just a number, it’s your financial reputation. Think of it as a “trust score” that lenders, landlords, and sometimes even employers use to decide whether to do business with you.

According to FICO, people with higher credit scores qualify for better loan terms, lower interest rates, and higher credit limits. For example, on a $250,000 mortgage, the difference between a 620 score and a 760 score could cost you over $60,000 in extra interest across 30 years.

Beyond loans, a strong score can also impact:

- Housing Landlords often run credit checks before approving rental applications.

- Some employers check credit reports (not scores) as part of background screening.

- Insurance premiums Insurers sometimes use credit data to set car and home insurance rates.

- Everyday peace of mind With good credit, you spend less time worrying about approvals and more time focusing on financial growth.

Bottom line: A good credit score doesn’t just save you money it opens doors to opportunities that would otherwise remain locked.

Factors That Impact Your Credit Score

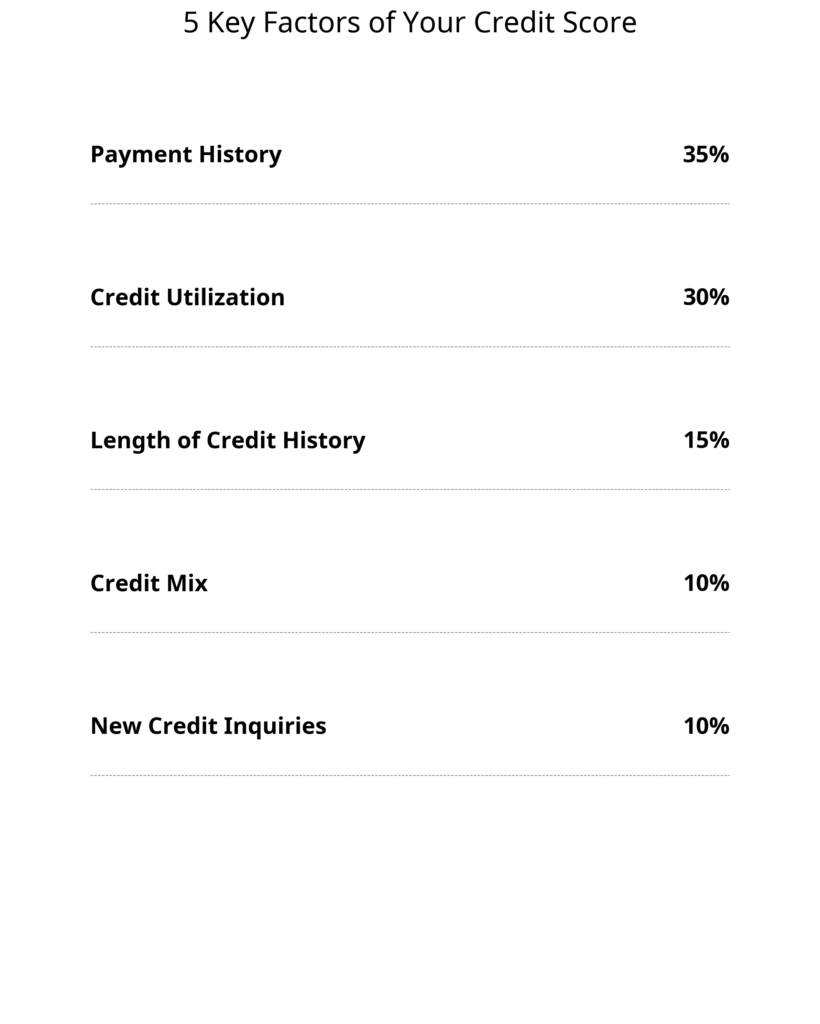

Your credit score is not random; it’s calculated using specific factors that reflect how you manage money. Here’s a breakdown, based on the FICO scoring model (used by 90% of top lenders):

- Payment History (35%)

- Did you pay bills on time? Even one 30-day late payment can drop your score by 50–100 points.

- Positive streaks of timely payments gradually outweigh old mistakes.

- Credit Utilization (30%)

- How much of your available credit are you using?

- Keeping balances under 30% of your limit is good, but under 10% is excellent.

- Length of Credit History (15%)

- Lenders value long relationships. Closing old accounts shortens your history and can hurt scores.

- The average age of accounts matters, older is better.

- Credit Mix (10%)

- A healthy blend of credit cards, installment loans, and mortgages shows you can juggle different responsibilities.

- Having only one type of credit may limit your score potential.

- New Credit Inquiries (10%)

- Each hard inquiry from applying for credit can drop your score by a few points.

- Multiple inquiries in a short time may suggest financial distress.

According to Experian, the single best way to improve across all these categories is consistency: steady payments, low balances, and careful borrowing habits.

Think of your score like a report card. Payment history is your “final exam,” utilization is your “homework,” and the rest are smaller assignments. Do well on the big items, and your grade (score) improves naturally.

10 Proven Strategies To Improve Your Credit Score Fast

1. Pay Your Bills on Time, Every Time

If you remember just one thing from this guide, let it be this: payment history is the single most important factor in your credit score. It makes up about 35% of your total score, meaning even one late payment can do serious damage. Creditors want to know if you’re reliable, and the best way to show reliability is by paying on time every time.

Here’s the tricky part: life happens. You might forget a due date, misplace a bill, or simply get caught up in other expenses. That’s why tools like automatic payments and calendar reminders can be lifesavers. Setting up autopay for at least the minimum amount ensures you never miss a deadline, while reminders keep you aware of what’s coming up.

But what if you’ve already missed a payment? Don’t panic. Contact your creditor immediately. In many cases, if you’ve had a good track record, they might agree to remove the late fee or even not report the late payment at all. It never hurts to ask.

The bottom line is consistency. Paying on time doesn’t just boost your score, it builds a financial reputation that lenders trust. Think of it like building credit “muscle memory.” The more you practice timely payments, the stronger your financial profile becomes.

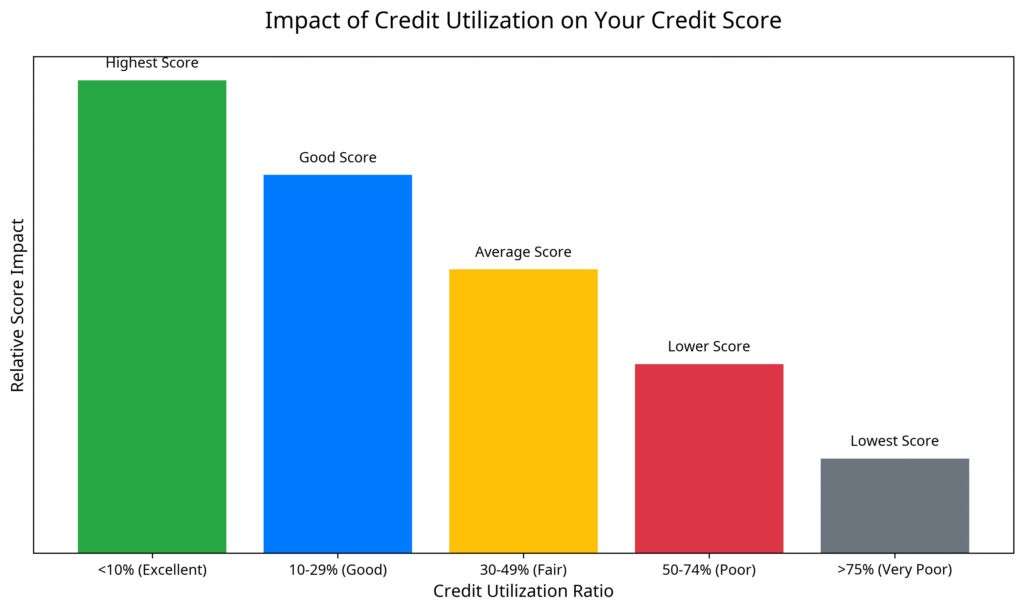

2. Reduce Credit Card Balances (Credit Utilization Ratio)

Your credit utilization ratio is the percentage of available credit you’re actually using. For example, if you have a $10,000 limit across all cards and you’re carrying $4,000 in balances, your utilization is 40%. Ideally, you want to stay under 30%and under 10% if possible for the best credit score impact.

Why does this matter so much? Because credit utilization shows lenders whether you’re overextended. If you’re constantly maxing out cards, it signals financial stress. On the other hand, low balances demonstrate that you can handle credit responsibly.

So how can you lower utilization quickly? Here are a few strategies:

- Make multiple smaller payments throughout the month instead of waiting for the due date. This keeps your balance low when the lender reports to credit bureaus.

- Ask for a credit limit increase (but don’t increase your spending). More available credit means a lower utilization ratio.

- Focus on paying down cards with the highest utilization first.

Reducing utilization can improve your score within a single billing cycle. It’s one of the fastest ways to see a boost because credit bureaus update your balances monthly.

3. Avoid Opening Too Many New Accounts

It’s tempting to apply for every credit card offer that comes your way, especially if there’s a juicy signup bonus. But here’s the catch: every time you apply, a hard inquiry appears on your credit report. Too many of these in a short period signals to lenders that you might be desperate for credit and that can hurt your score.

While one or two inquiries won’t destroy your credit, multiple applications in quick succession can lower your score by several points each. The effect usually fades within a year, but in the meantime, it could be the difference between getting approved or denied for a major loan.

Now, there are times when opening a new account makes sense. For example, if you’re building credit from scratch, a secured credit card or entry-level unsecured card can help. Or if you’re consolidating debt with a balance transfer offer, the long-term benefits might outweigh the short-term score dip.

The key is moderation. Think of credit accounts like tools you don’t need every tool in the store, just the right ones for the job. A well-curated set of accounts, used wisely, is much better than a drawer full of unused cards.

4. Don’t Close Old Accounts

When it comes to credit, age matters. The longer your accounts have been open, the better it looks to lenders. That’s because the length of your credit history makes up about 15% of your score. So if you’ve had a credit card for 10 years, that history is helping your score even if you don’t use the card much.

A common mistake people make is closing old accounts they no longer use. Maybe it’s an old store card or a card with a high annual fee. But closing it can shorten your credit history and increase your utilization ratio, both of which hurt your score.

Instead, consider alternatives:

- If the card has no annual fee, keep it open and use it for a small recurring bill (like Netflix or Spotify). Then set up autopay to keep it active.

- If it does have a fee, call the issuer and ask to downgrade to a no-fee version rather than closing it completely.

Keeping old accounts alive shows you have a long track record of handling credit, which makes lenders feel more confident in you.

5. Check Your Credit Reports for Errors

You might be surprised to learn that errors on credit reports are very common. According to studies, about 1 in 5 people has at least one mistake on their reportanything from incorrect account balances to accounts that don’t even belong to them. And yes, these errors can drag down your score unfairly.

That’s why it’s crucial to check your credit reports regularly. You’re entitled to one free report per year from each of the three major bureaus (Equifax, Experian, and TransUnion) through Annual Credit Report. Reviewing them helps you catch inaccuracies before they cause serious damage.

If you do find an error, don’t ignore it. File a dispute with the credit bureau right away. They’re legally required to investigate and resolve the issue, usually within 30 days. Provide supporting documents like bank statements or payment confirmations to strengthen your case.

Inaccurate information can be like carrying someone else’s baggage on your financial journey. By clearing it up, you lighten your load and give your credit score a fair chance to shine.

6. Negotiate With Creditors and Debt Collectors

Debt can feel like quicksand, the more you struggle, the deeper you sink. But here’s some good news: creditors and debt collectors often prefer negotiation over getting nothing at all. That means you may be able to settle your debts for less than the full balance and, in some cases, improve your credit standing at the same time.

One effective approach is called a “pay for delete” agreement. This is where you negotiate with a creditor or collection agency to remove the negative mark from your credit report once you’ve paid the debt (either in full or a reduced settlement). Not every creditor agrees to this, but many do, especially if the account is small or has been unpaid for a while.

If “pay for delete” isn’t an option, you can still request that the account be updated as “paid in full” or “settled.” While these notes don’t carry as much weight as full deletion, they do show future lenders that you took responsibility for your debt.

Another powerful tactic is simply asking for goodwill adjustments. If you’ve been a good customer but slipped up once, call your creditor and explain the situation. Many will agree to remove the negative entry as a gesture of goodwill.

Negotiating doesn’t just help your credit it can relieve massive financial stress. Knowing you’ve taken control of your debt gives you confidence and clears the path toward rebuilding a healthier credit profile.

7. Become an Authorized User on a Trusted Account

If you have a family member or close friend with a strong credit history, you can boost your own credit by becoming an authorized user on their credit card account. This strategy is often called “credit piggybacking.”

Here’s how it works: when you’re added as an authorized user, the account’s history (balance, age, and payment record) appears on your credit report too. That means if the primary cardholder has excellent credit habits, you instantly benefit from their financial discipline.

The benefits are huge; you don’t even have to use the card to see improvements. As long as the account is in good standing, your score can rise just by being listed.

But there are risks. If the primary cardholder racks up debt or misses payments, those negative marks can spill over to your report as well. That’s why you should only ask someone who is extremely responsible with money.

When done right, this method can fast-track your credit recovery. It’s like borrowing someone’s financial credibility until you’ve built up your own.

8. Use a Secured Credit Card Responsibly

For those with little or damaged credit, a secured credit card can be a game-changer. Unlike traditional cards, secured cards require a refundable cash deposit (usually $200–$500) that acts as your credit limit. Because there’s little risk to the lender, they’re much easier to qualify for even with poor credit.

The key is using the card responsibly. That means:

- Keep your utilization low (ideally under 30%).

- Pay your balance in full each month.

- Avoid maxing out the card, even if the limit is small.

Over time, your positive payment history is reported to the credit bureaus, steadily improving your score. After six to twelve months of good use, you can often upgrade to an unsecured card and get your deposit back.

One big mistake people make is treating secured cards like “training wheels” and ignoring the responsibility. But if you see it as a tool to rebuild trust, it can become one of the most powerful credit-repair strategies available.

9. Mix Up Your Credit Types

Credit scoring models don’t just look at how much credit you have, they also consider the types of credit you manage. This is called your credit mix, and it accounts for about 10% of your score.

There are two main types of credit:

- Revolving credit (like credit cards), where the balance can go up and down.

- Installment credit (like mortgages, car loans, or student loans), where you pay a fixed amount each month until the loan is complete.

Having a healthy balance of both shows lenders that you can handle different financial responsibilities. For example, if you only have credit cards, adding a small installment loan (such as a credit-builder loan) can improve your score.

That said, don’t take on unnecessary debt just to diversify. The goal isn’t to collect every type of account, but to demonstrate financial balance. Think of it like a diet variety helps, but too much of everything leads to problems.

10. Set Up Automatic Payments and Budgeting Tools

Life gets busy, and even the most responsible people forget bills sometimes. That’s where automation comes in. Setting up automatic payments for at least the minimum due ensures you’ll never miss a deadline, which protects your credit score.

But automation is not just about payments, it’s also about budgeting. Modern apps like Mint, YNAB (You Need A Budget), or even simple bank alerts can help you track spending, monitor due dates, and stay on top of financial goals.

Another great tool is linking your credit cards to your checking account and setting weekly balance alerts. This prevents you from accidentally overspending and helps you keep your utilization ratio in check.

The key is to remove human error from the equation. By letting automation handle the routine stuff, you free up mental space to focus on bigger financial decisions. Over time, this disciplined approach keeps your credit healthy and stress levels low.

Additional Tips to Boost Credit Score Faster

In addition to the 10 proven strategies, here are a few extra tips that can speed up your progress:

- Credit-builder loans: Many community banks and credit unions offer small loans designed specifically to build credit. You borrow a small amount, which is held in a savings account while you make payments. At the end, you get the money back, plus a stronger credit profile.

- Rent and utility reporting: Services like Experian Boost or Rental Kharma let you add on-time rent and utility payments to your credit report. These bills usually don’t count toward credit unless reported.

- Responsible co-signing: If someone with good credit co-signs a loan for you, it can help you qualify and improve your score. Just be careful, since any missed payments affect both of you.

These aren’t essential, but they can add extra momentum to your credit improvement journey.

How long does it take to improve your credit score?

When you’re working on improving your credit score, one of the most common questions is: “How fast will I see results?” The truth is, it depends on your situation, but most people notice changes within 30 to 90 days if they apply the right strategies consistently.

Some actions like paying down high credit card balances or disputing an error can lead to immediate score bump because credit bureaus update monthly. For example, if you pay off $2,000 on a card that’s close to its limit, your utilization ratio drops, and your score could rise significantly in just one billing cycle.

Other strategies take longer. Building a strong payment history, keeping accounts open, and showing credit diversity can take months or even years to fully reflect. But remember, credit scoring is about trends over time. The more positive habits you stack, the stronger your credit foundation becomes.

It’s also important to know that not all improvements show up evenly across the three major bureaus (Equifax, Experian, and TransUnion). One bureau might reflect changes faster than another, which is why checking all three reports is key.

Think of credit improvement like growing a garden. You can water the plants today, but you won’t see flowers tomorrow. With patience and consistent care, though, the results are inevitable and long-lasting.

Common Mistakes to Avoid When Improving Credit Score

While there are many proven strategies to boost your score, there are also pitfalls that can undo your hard work. Here are some of the most common mistakes people make:

1. Closing Accounts Too Soon

As mentioned earlier, closing old accounts shortens your credit history and can increase your utilization ratio. Unless an account has a steep annual fee or other problems, it’s usually better to leave it open.

2. Applying for Too Much Credit at Once

Every application triggers a hard inquiry, which can lower your score. Applying for multiple cards or loans in a short timeframe looks risky to lenders. Spread out applications and only apply when necessary.

3. Ignoring Small Debts and Collections

Even a $50 unpaid medical bill can harm your credit if it goes to collections. Small debts are often overlooked, but they can be just as damaging as larger ones. Always settle them quickly to avoid unnecessary hits to your score.

4. Paying Off Debts Without Checking Reporting Practices

Sometimes, paying off a collection account doesn’t automatically remove it from your credit report. Always negotiate before hand request deletion or at least a “paid in full” status.

5. Relying Only on Quick Fixes

Some companies promise to “fix” your credit overnight. The truth is, there are no instant miracles. Sustainable improvement comes from consistent habits, not shortcuts.

Avoiding these mistakes ensures your hard work doesn’t go to waste. Think of it like climbing a mountain. Why take a step back for every step forward when you can stay focused on reaching the top?

Conclusion: Building a Strong Financial Future

Improving your credit score doesn’t have to feel overwhelming. By following these 10 proven strategies, you can create real, lasting improvements faster than you might think. From paying your bills on time to lowering your credit utilization, checking for errors, and using tools like secured cards, each step moves you closer to financial freedom.

The key is consistency. Credit scores reward long-term responsible behavior, but small, smart moves add up quickly. Even if you’ve made mistakes in the past, your credit history isn’t permanent, it’s a living record that can change with your actions starting today.

A higher credit score means more than just bragging rights. It can save you thousands in interest, open up new financial opportunities, and even reduce everyday stress. It’s like unlocking a new level in your financial life where lenders trust you, doors open wider, and money works in your favor instead of against you.

So take action now. Pick one or two strategies from this guide, start applying them today, and watch your credit health improve step by step. Your future self will thank you for the discipline and effort you invest now.

Explore More Articles

FAQs About How To Improve Your Credit Score Quickly

1. What’s the fastest way to raise my credit score?

Paying down credit card balances to lower your utilization ratio often gives the quickest boost, sometimes within a single billing cycle. This strategy works because utilization makes up 30% of your FICO score, so lowering it has an immediate impact.

2. Can paying off collections improve my score immediately?

It depends. Paying collections doesn’t always raise your score right away, since the record may still remain on your report. However, negotiating a “pay for delete” (where the collection agency removes the item once paid) or ensuring it’s updated as “paid” can speed up improvements.

3. Is it bad to check my credit score often?

Not at all. Checking your own credit is considered a soft inquiry, which has zero impact on your score. In fact, regularly monitoring your credit helps you catch errors, track progress, and stay motivated.

4. How much will my score increase if I pay off all debt?

Results vary depending on your credit profile. Paying off high utilization credit card debt can sometimes raise your score by dozens or even hundreds of points over time. On the other hand, paying off installment loans (like auto loans) might have less impact.

5. Can I get a mortgage with a fair credit score?

Yes, it’s possible to qualify with a fair score (580–669), but you’ll likely face higher interest rates and stricter terms. Improving your score before applying can save you tens of thousands in interest over the life of a 30-year loan.