Having a credit card can be essential for managing daily expenses and building financial credibility. However, if you have a low credit score, finding a suitable credit card for bad credit can be challenging. Fortunately, many credit card issuers offer specialized options to help individuals rebuild their credit and improve their financial standing.

This article provides a detailed breakdown of the best credit cards for bad credit in 2026. Whether you need a secured credit card, an unsecured option, or one with guaranteed approval, we’ve compiled a list of top choices to help you make an informed decision.

By the end of this guide, you’ll understand the benefits of each credit card offer, how they can help you build credit, and what to consider when applying for a credit card to ensure you choose the best option for your financial situation.

Key Takeaways

- A credit card can be a valuable tool for improving your credit score if used responsibly.

- Secured credit cards often require a security deposit, which serves as collateral and determines your credit limit.

- Some unsecured credit cards are available for those with bad credit, but they may have higher annual fees and interest rates.

- A credit builder card can help you establish a positive credit history by reporting your activity to the three major credit bureaus.

- Regularly reviewing your credit report can help you track progress and identify areas for improvement.

What Is a Credit Card?

A credit card is a financial tool issued by a credit card company that allows users to borrow money up to a set credit limit for purchases, bill payments, and cash advances. Unlike debit cards, which withdraw money directly from a bank account, a credit card functions as a short-term loan that must be repaid, often with interest.

How Credit Cards Work

When you use a credit card, the card issuer covers the cost of the purchase, and you are required to repay the borrowed amount by the due date. If you do not pay in full, interest may be charged on the remaining balance. Responsible usage, such as paying your balance on time and keeping your credit utilization ratio low, can help you build credit history and improve your credit score.

Types of Credit Cards

There are different types of credit cards, including:

- Secured Credit Cards: Require a refundable security deposit and are ideal for those looking to rebuild their credit.

- Unsecured Credit Cards: Do not require a deposit but often have stricter approval requirements and higher fees.

- Rewards Credit Cards: Offer cashback, points, or travel rewards based on spending.

- Balance Transfer Cards: Allow users to transfer high-interest debt to a card with a lower interest rate.

Choosing the right credit card depends on your financial goals, spending habits, and credit history.

Understanding Credit Cards for Bad Credit

Why You Need a Credit Card to Rebuild Credit

If you have bad credit, getting a credit card may seem difficult, but it can actually be a critical step in rebuilding your financial health. Using a credit card responsibly helps demonstrate good financial habits to major credit bureaus, ultimately improving your credit score. When you make timely payments and keep your credit utilization ratio low, it signals to lenders that you can manage credit effectively.

How Credit Cards for Bad Credit Work

Most credit cards for bad credit fall into two categories: secured credit cards and unsecured credit cards.

- Secured credit cards require a refundable security deposit, which acts as collateral for the credit limit. These are often the best option for individuals looking to rebuild their credit since they typically report to the three major credit bureaus.

- Unsecured credit cards do not require a deposit but may come with higher annual fees, stricter approval requirements, and lower credit limits.

Understanding the differences between these types of credit cards can help you decide which is best suited for your financial situation.

Factors to Consider Before Applying For A Credit Card

Before you apply for a credit card, consider the following:

- Annual Fees: Some credit card companies charge an annual fee, which can vary based on the card’s features and benefits.

- Interest Rates: A higher APR can make it costly to carry a balance.

- Credit Limit: Some cards offer credit limit increases over time with responsible use.

- Reporting to Credit Bureaus: Ensure the card reports to all three major credit bureaus to effectively build credit history.

- Approval Requirements: Some cards offer guaranteed approval, while others require a minimum credit score.

By keeping these factors in mind, you can choose a credit card that aligns with your financial goals and helps you rebuild your credit effectively.

9 Best Credit Cards for Bad Credit

1. Discover it® Secured Credit Card

The Discover it® Secured Credit Card is an excellent choice for individuals looking to rebuild their credit with responsible use. This secured credit card requires a refundable security deposit, which determines the credit limit.

Key Features:

- Cashback Rewards: Earn 2% cashback at gas stations and restaurants and 1% on other purchases.

- Automatic Credit Review: Get evaluated for a credit limit increase after seven months.

- Reports to Major Credit Bureaus: Helps build credit history by reporting to all three major credit bureaus.

2. Capital One Platinum Secured Credit Card

The Capital One Platinum Secured Credit Card is another solid option for those with bad credit. Unlike traditional secured credit cards, this one allows for a lower security deposit while still providing access to a credit line.

Key Features:

- Low Security Deposit Options: Depending on creditworthiness, you may qualify for a credit limit with as little as $49.

- Credit Limit Increase Opportunity: After five months of on-time payments, you may get a higher credit limit.

- No Annual Fee: Unlike some credit cards for bad credit, this card has no annual fee, making it an affordable choice.

3. OpenSky® Secured Visa® Credit Card

The OpenSky® Secured Visa® Credit Card is ideal for individuals who want to avoid a credit check when applying. This secured credit card is accessible to those with low credit scores and helps in building credit history.

Key Features:

- No Credit Check Required: Approval is not based on your credit score alone.

- Build or Rebuild Credit: Reports to all three major credit bureaus.

- Adjustable Credit Limits: Your credit limit is determined by your refundable security deposit.

4. Credit One Bank Platinum Visa for Rebuilding Credit

Credit One Bank Platinum Visa for Rebuilding Credit is unsecured credit card is designed for individuals looking to rebuild their credit without the need for a security deposit.

Key Features:

- Unsecured Card: No security deposit is required.

- Credit Limit Increases Over Time: Responsible usage may lead to credit limit increases.

- Cashback Rewards: Earn 1% cashback on eligible purchases.

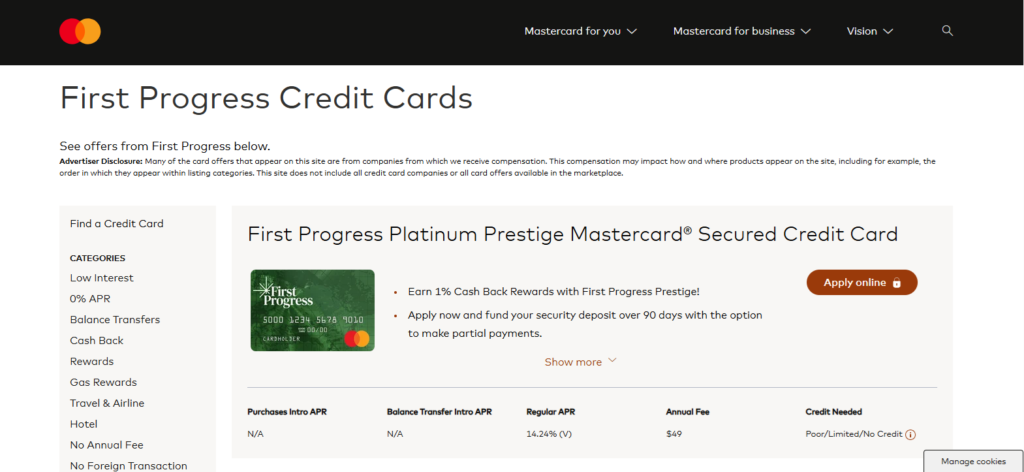

5. First Progress Platinum Prestige Mastercard® Secured Credit Card

The First Progress Platinum Prestige Mastercard® is a secured credit card that offers a relatively lower interest rate compared to similar options.

Key Features:

- Low APR: Helps cardholders manage their balances with a competitive interest rate.

- Credit Building: Reports to all three major credit bureaus.

- Flexible Credit Limits: Credit limits depend on the security deposit.

6. Indigo® Mastercard® for Less Than Perfect Credit

The Indigo® Mastercard® is designed for people with bad credit who want an unsecured credit card without a security deposit.

Key Features:

- Pre-Qualification Available: Check eligibility without affecting your credit score.

- No Security Deposit Required: A great option for those looking to avoid upfront deposits.

- Credit Reporting: Helps in building credit history.

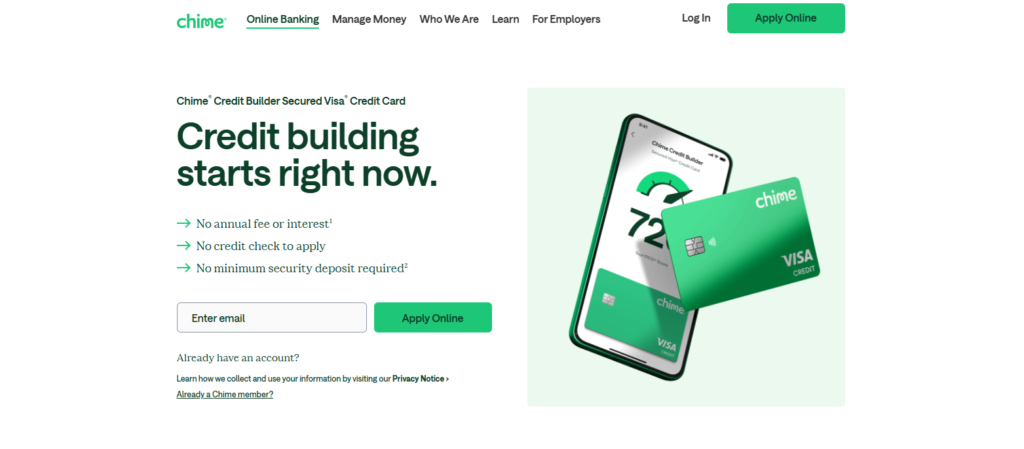

7. Chime Credit Builder Visa® Card

The Chime Credit Builder Visa® Card is a unique alternative to traditional secured credit cards that does not require a security deposit and works in tandem with a Chime Spending Account.

Key Features:

- No Fees: No annual fees, security deposit, or interest charges.

- Credit Limit Based on Deposits: The amount of money you transfer to the account becomes your credit limit.

- Reports to Credit Bureaus: Helps improve credit history.

8. Surge Mastercard® Credit Card

The Surge Mastercard® is an unsecured credit card option for those with low credit scores.

Key Features:

- Potential Credit Limit Increases: Eligible users may receive a credit limit increase over time.

- Reports to Three Major Credit Bureaus: Helps build or rebuild credit.

- Easy Application Process: Pre-qualify without impacting your credit score.

9. Milestone® Gold Mastercard®

The Milestone® Gold Mastercard® is another unsecured credit card designed for those with bad credit.

Key Features:

- Pre-Qualification Without Impact to Credit: Find out eligibility without affecting your credit score.

- No Security Deposit Required: Unlike secured credit cards, this one does not require a deposit.

- Reports to Credit Bureaus: Helps users rebuild their credit over time.

How to Choose the Right Credit Card for Bad Credit

Consider the Fees

Some credit cards for bad credit have high annual fees or hidden costs. It’s essential to check:

- Annual Fees: Some cards charge up to $99 per year.

- Foreign Transaction Fees: If you travel frequently, look for a card with no foreign transaction fees.

- Late Payment Fees: Avoid cards with hefty penalties for missed payments.

Look for Cards That Report to Credit Bureaus

To effectively rebuild your credit, ensure your credit card issuer reports your activity to all three major credit bureaus (Experian, Equifax, and TransUnion).

Choose Between Secured and Unsecured Options

- If you can afford a security deposit, a secured credit card may be a safer way to build credit.

- If you prefer an unsecured card, be aware of potential high fees and lower credit limits.

Features to Look for in a Credit Card for Bad Credit

1. Low or No Annual Fees

When choosing a credit card for bad credit, it’s essential to consider the annual fee. Some credit cards charge a yearly fee just for maintaining the account. While this is common among unsecured credit cards, there are options with low or no annual fees. A lower fee means you can focus on repaying balances and improving your credit score rather than covering unnecessary costs.

2. Reports to All Three Major Credit Bureaus

One of the primary reasons for using a credit card responsibly is to build credit history. To do this effectively, the card issuer must report your payment history to the three major credit bureaus—Experian, Equifax, and TransUnion. A credit card that reports your activity helps demonstrate responsible credit use and improve your credit score over time.

3. Reasonable Interest Rates

The interest rate, also known as the annual percentage rate (APR), is crucial when selecting a credit card. People with low credit scores often receive higher credit rates, but some credit card issuers offer relatively competitive APRs. Choosing a card with a lower APR helps reduce costs if you carry a balance.

4. Path to a Credit Limit Increase

Some credit cards for bad credit offer a credit limit increase after a period of responsible use. This can help improve your credit utilization ratio, which is a key factor in determining your credit score. If you’re working on rebuilding credit, a higher credit limit can provide more financial flexibility while demonstrating responsible credit management.

5. No Hard Credit Check for Prequalification

Many credit cards for bad credit allow potential applicants to check their eligibility through a soft credit check before officially applying. This prevents an unnecessary hard inquiry, which could temporarily lower your credit score. Choosing a card with prequalification options can help you find the best match without negatively affecting your credit history.

6. Security Deposit Requirements

For those considering a secured credit card, the security deposit is a crucial factor. Most secured credit cards require an upfront deposit that determines the credit limit. Some credit card issuers allow you to increase your deposit over time to raise your credit line. Others may even offer a refundable security deposit after demonstrating responsible use, transitioning the card into an unsecured credit card.

7. Rewards and Benefits

Although most credit cards for bad credit focus on helping you build credit, some offer additional perks such as cashback rewards, fraud protection, or free credit monitoring. If possible, look for a card that provides extra benefits without excessive fees or high interest rates. Some credit card companies also offer programs to help rebuild your credit, such as financial education resources or automatic credit line reviews.

8. Flexible Payment Options and Alerts

Managing a credit card responsibly includes making on-time payments. Some credit cards offer flexibility in payment scheduling, autopay features, and alerts to remind you when your due date is approaching. These features can help prevent missed payments, which can negatively impact your credit.

9. Upgrade Options

A great feature to consider when choosing a credit card for bad credit is the ability to upgrade to a better card in the future. Some secured credit cards allow you to transition to an unsecured card after demonstrating responsible credit use. This means you can eventually access a card with better rewards and lower interest rates without needing to apply for a new credit card.

10. Fraud Protection and Security Features

Even with bad credit, security should not be overlooked. The best credit cards for bad credit offer fraud protection measures such as zero-liability policies, account monitoring, and access to your credit report. These features protect your account from unauthorized transactions and help you stay on top of your credit status.

By considering these key features, you can select a credit card that aligns with your financial needs and helps you work toward a better credit history.

How to Use Your Credit Card Responsibly to Build Credit

1. Make Payments on Time

One of the most important factors in building a positive credit history is making timely payments. Your payment history accounts for a significant portion of your credit score, so ensuring that you pay at least the minimum amount due each month can help you improve your credit. Setting up automatic payments or reminders can prevent missed payments that might negatively impact your credit.

2. Keep Your Credit Utilization Low

Your credit utilization ratio measures how much of your available credit you’re using compared to your credit limit. A lower utilization ratio can positively affect your credit score. Ideally, you should keep your credit utilization below 30% of your total credit limit. For example, if you have a credit limit of $1,000, try to keep your balance below $300.

3. Avoid Applying for Too Many Credit Cards

Every time you apply for a credit card, a credit check (hard inquiry) is performed, which can temporarily lower your credit score. Too many applications within a short period can make lenders view you as a risky borrower. Instead, focus on one credit card for bad credit, use it responsibly, and wait for your credit score to improve before applying for another.

4. Pay Off Your Credit Card Balance in Full

Whenever possible, try to pay off your credit card balance in full each month. Carrying a balance can result in high-interest charges, especially if your credit card has a high APR. Paying off your balance not only saves you money but also helps you build a strong credit history and demonstrates responsible credit card usage.

5. Monitor Your Credit Report Regularly

Regularly checking your credit report allows you to track your progress and identify any errors or fraudulent activity. You can access your credit report from the three major credit bureaus—Experian, Equifax, and TransUnion. If you find inaccuracies, you should dispute them to ensure your credit score accurately reflects your financial behavior.

6. Request a Credit Limit Increase Over Time

Once you have demonstrated responsible use of your credit card, some credit card issuers may offer a credit limit increase. A higher credit limit can improve your credit utilization ratio, which may contribute to an improved credit score. However, avoid increasing your spending just because you have a higher credit line.

7. Upgrade to a Better Credit Card

If you started with a secured credit card, your goal should be to transition to an unsecured credit card once your credit score improves. Many credit card issuers allow cardholders to upgrade their accounts after demonstrating responsible credit use for a period of time. This can help you access better rewards and lower interest rates.

8. Keep Your Credit Card Account Open

Unless you have a compelling reason to close your credit card, it’s often best to keep it open. The length of your credit history contributes to your credit score, so maintaining an account with a good payment history can benefit you in the long run. Closing an account can also reduce your available credit, which may negatively affect your credit utilization ratio.

9. Use Your Card Responsibly

Using your credit card responsibly means avoiding overspending and ensuring that you can afford to pay off your balance. Responsible usage can lead to better financial opportunities, such as lower interest rates, higher credit limits, and improved borrowing options in the future.

By following these steps, you can use your credit card as a tool to rebuild your credit and establish a strong financial foundation.

Final Thoughts- Best Credit Cards For Bad Credit

Finding the right credit card when you have bad credit can be challenging, but the right choice can help you rebuild your credit and improve your financial future. Whether you opt for a secured credit card or an unsecured option, using it responsibly is key to raising your credit score over time. By making timely payments, keeping your credit utilization ratio low, and regularly reviewing your credit report, you can gradually work toward better credit opportunities.

Remember, credit cards for bad credit are stepping stones toward stronger financial health. Once your credit score improves, you may qualify for better cards with lower interest rates and more rewards. Stay disciplined, monitor your progress, and make informed decisions to maintain a positive credit history.

Explore More Articles

Frequently Asked Questions (FAQs)

1. What is the easiest credit card to get with bad credit?

Secured credit cards are usually the easiest to get since they require a security deposit that acts as collateral. Some unsecured credit cards also offer guaranteed approval, but they may come with high annual fees and interest rates.

2. Will applying for a credit card hurt my credit score?

When you apply for a credit card, the card issuer will perform a credit check, which may temporarily lower your credit score. However, responsible use of the credit card can help you build credit history and improve your score over time.

3. How long does it take to rebuild credit with a credit card?

It depends on factors like your starting credit score, payment history, and credit utilization ratio. Typically, consistent responsible use over 6-12 months can lead to noticeable improvements in your credit score.

4. Can I get a credit card with no credit check?

Some credit cards for bad credit offer guaranteed approval without a credit check, but they often come with higher fees or require a security deposit. Always read the terms carefully before applying.

5. What is the difference between a secured and an unsecured credit card?

A secured credit card requires a refundable security deposit, which acts as your credit limit. An unsecured credit card does not require a deposit, but it may have stricter approval requirements and higher interest rates.

6. How much should I spend on my credit card each month?

To maintain a good credit utilization ratio, it’s best to use less than 30% of your credit limit. For example, if your credit limit is $1,000, keep your balance below $300.

7. How do I increase my credit limit?

Many credit card issuers offer a credit limit increase after several months of responsible use. Making on-time payments and keeping your credit utilization low can improve your chances of receiving an increase.

8. Should I close my credit card after improving my credit score?

Keeping your credit card open helps maintain your credit history and overall credit utilization ratio. If the card has a high annual fee, consider upgrading to a better option rather than closing it.