Are you new to investing and looking for a way to grow your money? Starting your investing journey can feel daunting, especially for beginners with little money, but it doesn’t have to be. This article explores the 10 best stocks for beginners with little money to build a portfolio, whether you’re a beginner investor or have limited funds. We’ll break down essential steps to invest in stocks, types of stocks to consider, and tips to get started investing in the stock market confidently.

By the end of this article, you’ll have a clear understanding of how to choose stocks, the risk of investing, and why these 10 stocks are ideal for beginners. Let’s dive in and help you start investing with little money today!

Why You Should Invest in Stocks

Investing in stocks is one of the best ways for beginners to grow their wealth over time. The stock market offers a broad range of stocks, from blue-chip stocks to growth stocks, allowing investors to diversify their portfolios and achieve their financial goals. Here are some key reasons to start investing in stocks:

1. Build Long-Term Wealth

Stocks for the long haul have historically provided higher returns compared to other investment options like bonds or savings accounts. Investing involves risks, but disciplined investing and focusing on stocks with strong growth potential can lead to significant wealth accumulation.

2. Generate Passive Income

Dividend-paying stocks offer a reliable source of passive income. These stocks pay regular dividends, which can be reinvested to compound your returns or used to supplement your income.

3. Start Small and Grow

Thanks to fractional share investing, beginners with limited funds can invest in stocks with as little as a few dollars. This makes it possible for anyone to begin investing and grow their money over time.

Why Beginners Should Start Investing in Stocks

Investing in the stock market is one of the best ways to grow your money over time. For beginners, stocks may seem intimidating, but they offer unmatched potential for long-term investing. With thousands of stocks for beginners available, beginner investors can start building a portfolio tailored to their goals. Whether you’re investing with limited funds or aiming to pick individual stocks, this guide will show you how to get started.

Benefits of Investing In Stocks for Beginners

- Compound Growth: Stocks make your money grow exponentially through compound interest.

- Accessibility: Thanks to fractional share investing, you can invest as little as a few dollars.

- Diversification: By investing in different stocks, you reduce the risk of putting all your money in one stock.

Understanding the basics of stock investing will help you develop disciplined investing habits and build a portfolio of stocks that matches your financial goals.

How to Start Investing in Stocks For Beginners With Little Money

Starting your investing journey as a beginner with little money is easier than ever. With advancements in technology and the availability of the best online brokers, you can start investing in stocks for beginners with limited funds. Here’s how:

Step 1: Set Your Financial Goals

Before you invest in stocks, define your financial goals. Are you saving for retirement, a house, or building wealth? Knowing your goals will help you choose the right stocks and investment strategy.

Step 2: Choose the Best Investment Platform

Selecting the best brokers is crucial for successful investing. Look for platforms that offer low fees, user-friendly interfaces, and access to a broad range of stocks and ETFs. Some popular choices include platforms that allow fractional share investing, ideal for beginners.

Fractional share investing lets you buy stocks with a single dollar amount, even if the stock is trading at a high price. This is one of the best ways for beginners to start investing with little money.

Types of Stocks: Which Ones Should Beginners Choose?

Understanding the different stocks available in the market is essential for beginners to invest wisely. Here’s a breakdown of the most common investing options:

1. Blue-Chip Stocks

Blue-chip stocks are shares of well-established companies with a history of reliable performance. These stocks are ideal for beginners seeking stability and long-term investing opportunities.

2. Growth Stocks

Growth stocks represent companies expected to grow faster than the overall market. While they can offer high returns, they also come with a higher risk of investing in individual stocks.

3. Dividend Stocks

Dividend-paying stocks are a great choice for beginners looking to generate passive income. They provide regular payouts, which can be reinvested to compound growth.

4. Penny Stocks

Penny stocks are low-cost shares of smaller companies. While they can be tempting due to their affordability, they carry a higher risk and are not the best choice for beginners.

Building a Diversified Portfolio

A diversified portfolio of stocks helps minimize the risk of losing money while maximizing potential returns. Here are steps to build a balanced portfolio:

1. Mix Different Types of Stocks

Investing in a mix of blue-chip stocks, growth stocks, and dividend stocks ensures you have exposure to various sectors and risk levels. Stocks across different industries can protect your portfolio from market volatility.

2. Don’t Put All Your Money in One Stock

Avoid putting all your money into a single stock. Instead, spread your investments across a broad range of stocks to reduce the impact of any one stock’s poor performance.

3. Consider ETFs and Mutual Funds

ETFs and mutual funds are excellent options for beginners to start investing. They offer exposure to a portfolio of stocks or bonds, providing instant diversification.

How to Choose the Right Stocks

Choosing the best stocks for beginners requires research and a clear understanding of your investment goals. Here are some tips:

1. Research Company Fundamentals

Examine a company’s financial health, including its earnings, revenue growth, and debt levels. Stocks that match your investment goals and risk tolerance are the right stocks for your portfolio.

2. Focus on Long-Term Growth

Instead of chasing short-term gains, focus on stocks for the long haul. Long-term investing reduces the impact of market fluctuations and allows your money to grow.

3. Seek Professional Advice

If you’re new to investing, consulting a financial advisor can help you make informed decisions. A financial advisor can guide you on how to invest in stocks and build a portfolio tailored to your needs.

10 Best Stocks for Beginners With Little Money to Invest In

1. Apple Inc. (AAPL) – A Blue-Chip Stock Ideal for Beginners

Apple Inc. is one of the best stocks for beginners due to its consistent growth and strong brand. Investing in blue-chip stocks like Apple provides stability, making it a great choice for beginners. Apple’s dividend-paying stocks also allow beginners to earn passive income while their portfolio grows.

Why Apple is Great for New Investors

- Proven track record of long-term growth

- Offers stability during market fluctuations

- Accessible to investors through fractional shares

2. Amazon.com Inc. (AMZN) – Growth Stock for the Long Haul

Amazon is another excellent stock for beginners, especially those interested in growth stocks. With its dominance in e-commerce and cloud computing, Amazon offers a solid opportunity for long-term investing. While the stock is trading at a high price, fractional share investing makes it accessible to those with a small amount of money.

Key Features

- High potential for long-term growth

- Diversified revenue streams

- Ideal for beginners focusing on stocks for the long haul

3. The Coca-Cola Company (KO) – A Dividend-Paying Stock with Stability

Coca-Cola is one of the best investments and stocks for beginners who want a reliable income source. Known for its consistent dividends, Coca-Cola is a great stock to buy for steady returns.

Benefits for Beginners

- Stable dividend payouts

- Low volatility, reducing the risk of investing

- Perfect for beginners with limited funds

4. Microsoft Corporation (MSFT) – A Tech Stock with Proven Growth

Microsoft is an excellent choice for beginners to invest in the stock market. As a leader in tech stocks, Microsoft combines stability with growth, making it an attractive option for any portfolio of stocks.

Why Microsoft is a Top Pick

- Strong financial performance

- Long history of innovation

- Accessible for beginners through fractional shares

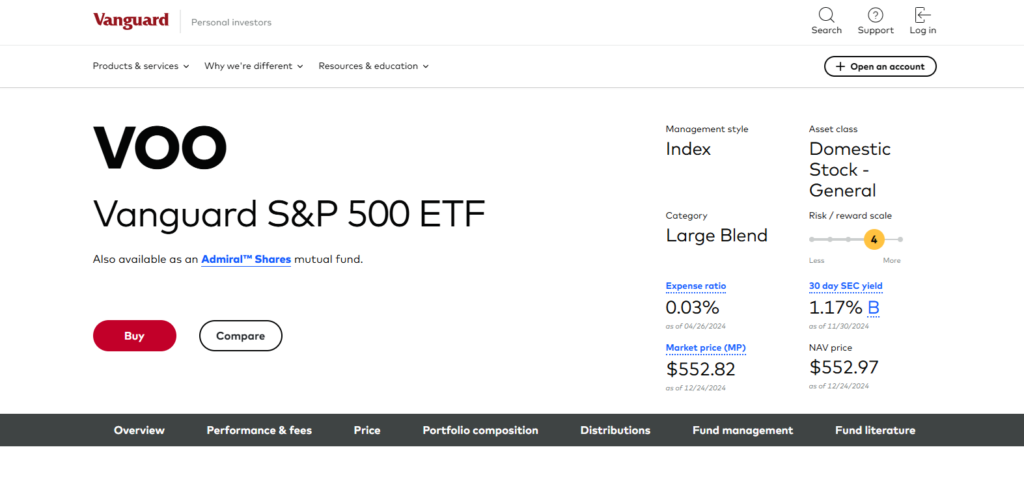

5. Vanguard S&P 500 ETF (VOO) – Diversification Through ETFs

For those new to investing, ETFs like Vanguard S&P 500 ETF offer exposure to a broad range of stocks. This stock investing method provides diversification and reduces the risk of losing money by spreading investments across different sectors.

Advantages

- Low-cost entry point

- Reduces the risk of investing in individual stocks

- Ideal for long-term investing

6. Tesla Inc. (TSLA) – Growth Potential with Innovative Leadership

Tesla is one of the best stocks for beginners looking to invest in growth stocks. Its leadership in electric vehicles and clean energy makes it a compelling choice for beginners to start investing.

Highlights

- High growth potential

- Leader in a rapidly growing industry

- Great for beginners aiming for long-term growth

7. Johnson & Johnson (JNJ) – Stability in Healthcare Stocks

Healthcare stocks like Johnson & Johnson are excellent for beginner investors seeking low-risk investments. This blue-chip stock provides a balance of stability and growth.

Benefits

- Strong dividend history

- Resilient during market downturns

- Suitable for long-term investing

8. Google (Alphabet Inc., GOOGL) – Innovation and Market Leadership

Google’s parent company, Alphabet, is one of the best stocks for beginners to invest in. Its dominance in online advertising and cloud computing ensures consistent growth.

Reasons to Invest

- High profitability

- Leader in technology and innovation

- Ideal for a diversified portfolio

9. Procter & Gamble Co. (PG) – Reliable Dividend Stock

Procter & Gamble is a top choice for beginners interested in dividend-paying stocks. Its diverse product range and consistent dividends make it a low-risk investment.

Why Choose Procter & Gamble

- Consistent returns

- Low-risk stock for beginners

- Adds stability to your portfolio

10. Berkshire Hathaway Inc. (BRK.B) – Long-Term Value Investing

Berkshire Hathaway is a solid choice for beginners focusing on disciplined investing. Led by Warren Buffett, it’s known for its value investing approach and diversified holdings.

Key Features

- Diversified investment portfolio

- Managed by one of the best investors

- Ideal for beginners to start investing in stocks

Common Mistakes to Avoid When Investing in Stocks

Investing without proper knowledge can lead to losing money. Here are some common investing mistakes and how to avoid them:

1. Emotional Decision-Making

Avoid making impulsive decisions based on market trends or fear. Disciplined investing and a long-term approach are key to successful investing.

2. Overlooking Diversification

Failing to diversify your portfolio can expose you to unnecessary risks. Investing in different stocks and ETFs helps mitigate these risks.

3. Ignoring Fees and Expenses

High fees can eat into your returns. Choose the best online brokers with low fees to maximize your investment returns.

Key Considerations for Beginner Investors

Understanding the Risk of Investing

Investing involves risks, especially when buying individual stocks. It’s essential to understand the risk of investing and balance your portfolio with stable options like dividend-paying stocks and ETFs. This ensures you don’t lose all your money due to market volatility.

How to Choose Stocks as a Beginner

Choosing the best stocks for beginners can be challenging. Focus on stocks with a proven track record, low volatility, and consistent growth. Stocks like Apple, Coca-Cola, and ETFs provide a way for beginners to invest safely and confidently.

Building a Diversified Portfolio

A diversified portfolio of stocks is key to reducing risk. Consider including different stocks, such as growth stocks, blue-chip stocks, and dividend stocks, to balance your investments.

Tips to Start Investing with Little Money

For beginners with limited funds, fractional share investing is a game-changer. It allows you to buy stocks with as little as a few dollars, making it easier to start investing without waiting to save a large amount of money.

Best Online Brokers for Beginners

Using the best brokers simplifies the process of investing in stocks. Look for brokers that offer low fees, fractional shares, and educational resources to help you make informed decisions.

Developing Disciplined Investing Habits

Successful investing requires discipline. Start by setting clear goals, staying consistent, and avoiding emotional decisions. Make investing a regular part of your financial plan to ensure long-term success.

Final Thoughts on the Best Stocks for Beginners With Little Money

Investing in the stock market is one of the best ways for beginners to grow their wealth. By focusing on stocks like Apple, Amazon, and ETFs, you can build a diversified portfolio that matches your goals. Remember, the key to successful investing is to start small, stay disciplined, and keep learning.

With this guide, you’re ready to take the first step in your investing journey. Happy investing!

More Articles:

- How To Make Your Money Work For You: 10 Smart Ways To Invest Your Money

- How to Become an Amazon Reviewer and Product Tester for Free Stuff

- How To Make Money On Audible.

- How to Make Money on Etsy: Complete Guide for Etsy Sellers

FAQs: Best Stocks For Beginners With little Money

1. What is the minimum amount needed to start investing in stocks?

You can start investing with as little as a few dollars using fractional share investing or low-cost index funds.

2. What are the best stocks for beginners to invest in?

Blue-chip stocks, growth stocks, and dividend-paying stocks are often ideal for beginners due to their stability and growth potential.

3. How do I choose the right stocks to invest in?

Research the company’s financial health, industry position, and growth prospects. Diversify your investments to reduce risk.

4. Should beginners invest in individual stocks or ETFs?

ETFs are a safer choice for beginners as they provide instant diversification, while individual stocks require more research and carry higher risks.

5. What is the risk of investing in individual stocks?

Individual stocks can be volatile, and there is a higher risk of losing money compared to diversified investments like ETFs.

6. How often should I monitor my stock investments?

Review your portfolio regularly, but avoid checking too frequently to prevent emotional decision-making.

7. Can I start investing with limited funds?

Yes, many brokers offer fractional share investing, allowing you to invest small amounts and build your portfolio gradually.

8. Do I need a financial advisor to start investing?

While not necessary, a financial advisor can provide valuable guidance and help you create a strategy tailored to your goals.